The last date for linking Aadhaar with PAN is 30th June 2023. PAN will become inoperative from 1st July 2023 if it is not linked with Aadhaar.

Applicability

The seamless integration of Aadhaar and PAN during the application stage is automatically conducted for new individual PAN card applicants. Existing individual PAN holders, who were assigned PAN on or before July 1st, 2017, are obligated to link their PAN with Aadhaar.

Exemptions from PAN-Aadhaar Linking

The following individuals are exempted from linking their PAN with Aadhaar if they do not possess an Aadhaar Number or Enrolment ID:

1. Non-Resident Individuals (NRIs) as per the Income Tax Act, 1961

2. Individuals who are not citizens of India

3. Individuals aged 80 years or above during the previous year, as stated in notification no. 37/2017 of the Ministry of Finance (Department of Revenue)

4. Residents of the following states:

i. Assam

ii. Meghalaya

iii. Jammu & Kashmir

Deadline

The original deadline for Aadhaar-PAN linking was March 31st, 2022, as per CBDT Circular No. 7/2022 dated March 30th, 2022. However, the timeline was extended to March 31st, 2023, according to CBDT Circular No. 3/2023 issued on March 28th, 2023. Furthermore, a further extension has been granted until June 30th, 2023, subject to the payment of late fees.

Late Fees

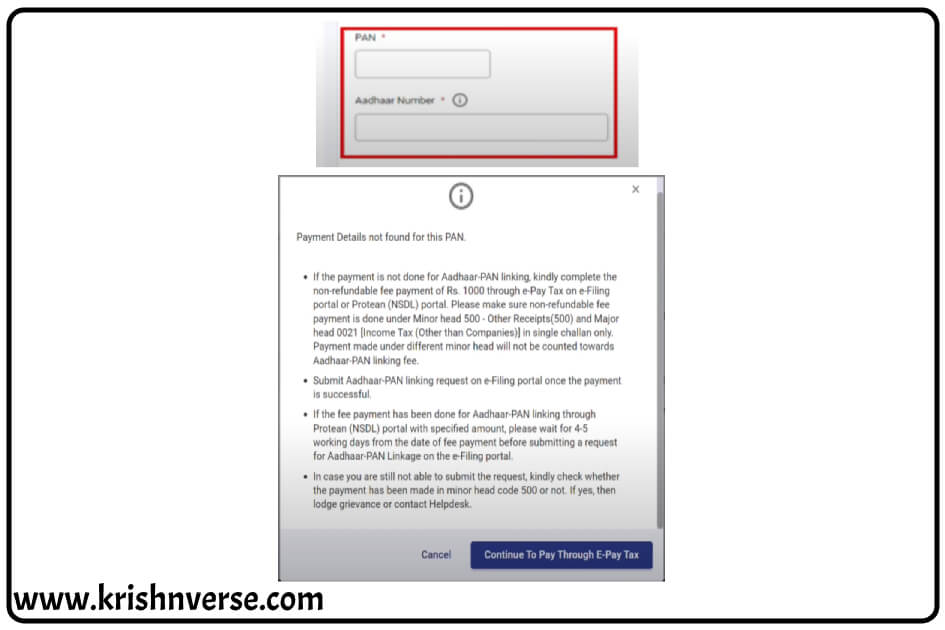

A non-refundable late fee of Rs. 1000/- is applicable for delayed PAN-Aadhaar linking.

Consequences of Not Linking PAN with Aadhaar

Failure to link PAN with Aadhaar will render the PAN inoperative, leading to various implications, including:

1. Inability to file returns using the inoperative PAN

2. Non-processing of pending returns

3. Non-issuance of pending refunds to the inoperative PAN

4. Incompletion of pending proceedings related to defective returns once the PAN becomes inoperative

5. Deduction of tax at a higher rate due to the inoperative PAN

6. Potential difficulties faced by taxpayers at banks and financial institutions, as PAN serves as an essential KYC document for all financial transactions.

Prerequisites for Aadhaar – PAN Linking

To link Aadhaar with PAN, individuals must possess the following:

1. Valid PAN

2. Aadhaar Number

3. Valid Mobile Number

Steps for Aadhaar-PAN Linking

The Aadhaar-PAN linking process can be completed in three broad steps:

1. Payment of applicable fees (Rs. 1000):

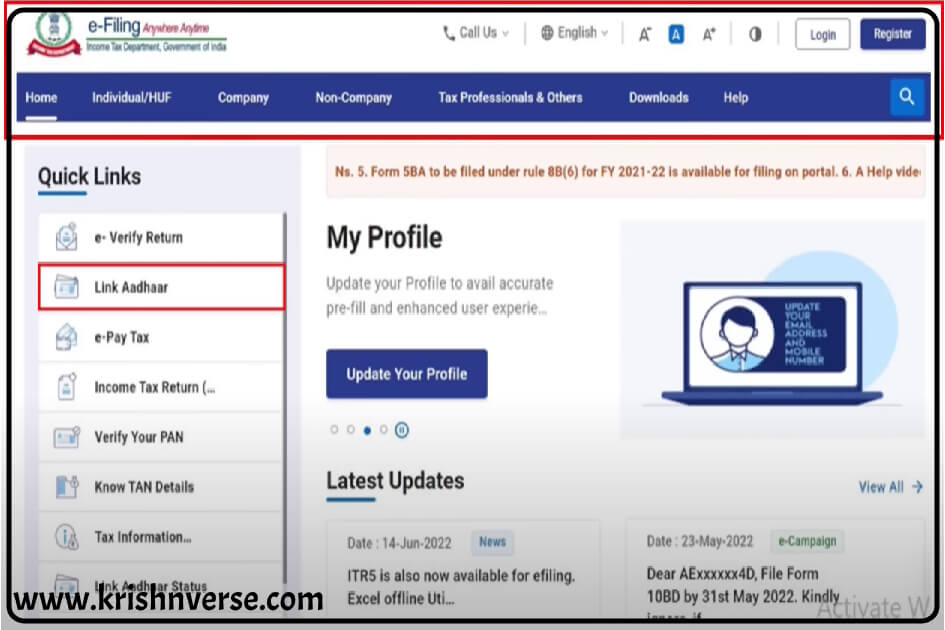

– Visit the official Income Tax e-portal at https://www.incometax.gov.in/iec/foportal/ and click on “Link Aadhaar.”

– Enter your PAN and Aadhaar Number, then click on “Continue To Pay Through E-Pay Tax.”

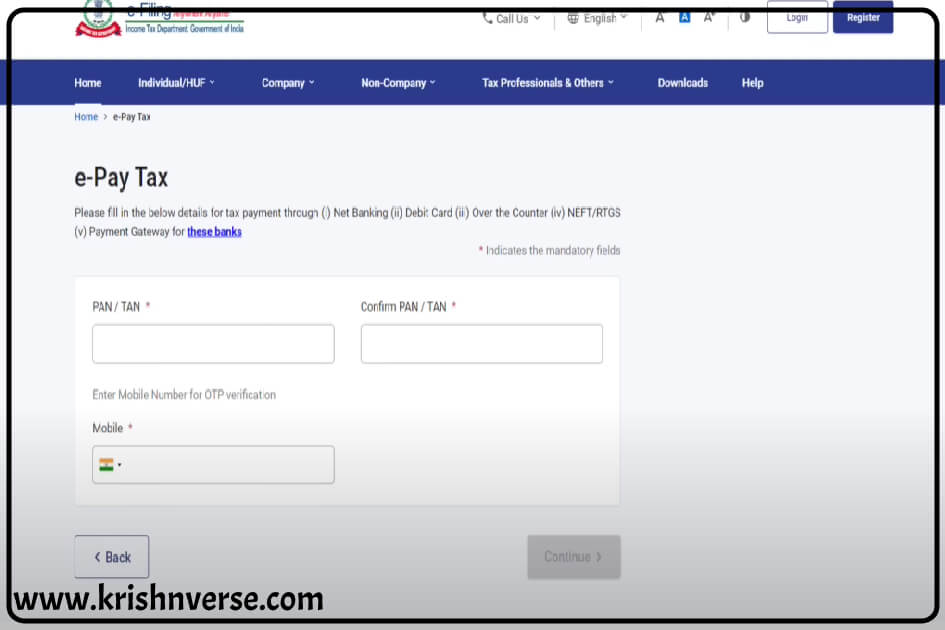

– On the next screen, re-enter your PAN, confirm PAN, and provide a valid mobile number to receive an OTP.

– Verify the OTP received on your mobile number.

– A successful message will be displayed, confirming the verification through mobile OTP. Click on “Continue” to proceed.

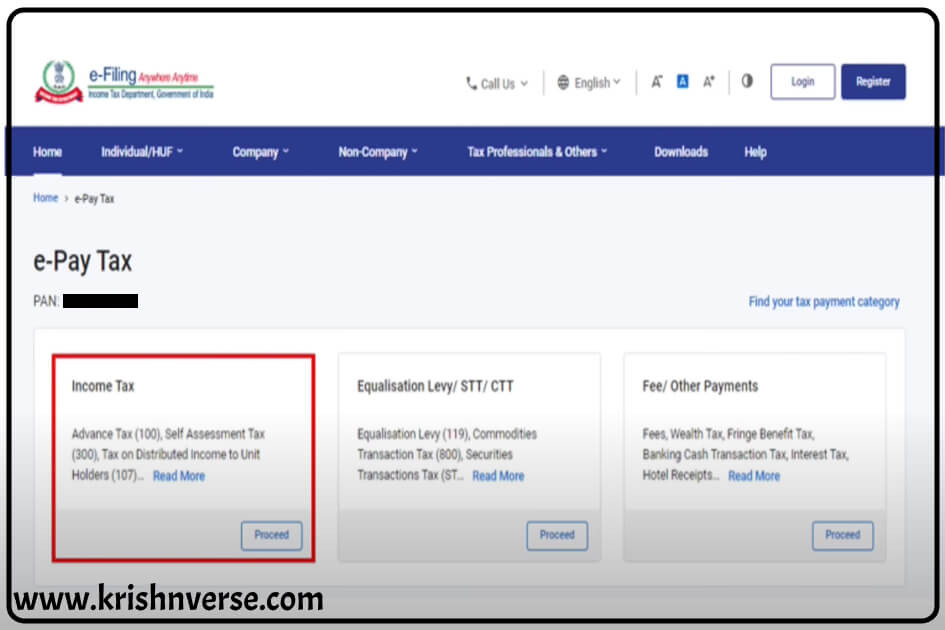

– Select the “2024-25” Assessment Year and “Other Receipts (500)” as the Type of Payment (Minor Head).

– You will be redirected to the next screen, showing an amount of Rs. 1000/- mentioned in the “Others” field. Click on “Continue.”

– A Challan will be generated, and on the following screen, you can choose the mode of payment, which will redirect you to the bank’s website for the final payment.

2. Submit Aadhaar-PAN linking request on the e-filing portal:

– After successfully paying the fees, you can link your Aadhaar with PAN on the e-filing portal.

– Aadhaar-PAN linking can be done in both Pre-login and Post-login modes.

– Post-login mode:

– Log in using your PAN and password.

– From the Dashboard, click on “Link Aadhaar to PAN” or go to the profile and click on “Link Aadhaar.”

– Enter your valid Aadhaar Number.

– Pre-login mode:

– Click on “Link Aadhaar” on the Home Page.

– Enter your PAN and Aadhaar, then click on the Validate button.

– Personal details, such as “Name as per PAN,” “DOB as per PAN,” “Gender as per PAN,” “Aadhaar Number,” and “Name as per Aadhaar,” will be displayed.

– Two checkboxes are available: “I have only the year of birth in Aadhaar Card” and “I Agree to validate my Aadhaar details.” Select the applicable checkbox and click on the “Link Aadhaar” button.

– An OTP will be sent to your mobile number. Enter the OTP and click on Validate.

– A message will be displayed, stating that your request for Aadhaar-PAN linking has been sent to UIDAI for validation. Please check the status later by clicking on the “Link Aadhaar Status” link on the Home Page.

3. Check Aadhaar-PAN linking status

– The status of the Aadhaar-PAN linking request can be checked in both Pre-login and Post-login modes.

– Pre-login mode:

– From the pre-login Home Page screen, click on “Link Aadhaar Status.”

– Enter your PAN and Aadhaar number, then click on “View Link Aadhaar Status.”

– Upon successful validation, a message will be displayed regarding your Link Aadhaar Status, such as “Your PAN XXXXXXXXXX is already linked to the given Aadhaar XXXXXXXXXXXX.”

– Post-login mode:

– Log in to your account with PAN and password.

– From the Dashboard, click on “Link Aadhaar Status” or go to the profile and click on “Link Aadhaar Status.”

Frequently Asked Questions (FAQ)

How can I check my Aadhaar link PAN status?

You can check the status of your Aadhaar link PAN in both Pre-login and Post-login modes:

Pre-login mode:

a. From the pre-login Home Page screen, click on “Link Aadhaar Status.”

b. Enter your PAN and Aadhaar number, then click on “View Link Aadhaar Status.”

c. Upon successful validation, a message will be displayed regarding your Link Aadhaar Status, such as “Your PAN XXXXXXXXXX is already linked to the given Aadhaar XXXXXXXXXXXX.”

Post-login mode:

a. Log in to your account with PAN and password.

b. From the Dashboard, click on “Link Aadhaar Status” or go to the profile and click on “Link Aadhaar Status.”

What is the use of PAN Aadhaar link?

The PAN Aadhaar link serves multiple purposes, including:

Facilitating seamless integration and verification of personal identification details.

Enhancing efficiency in filing tax returns and processing refunds.

Reducing the risk of tax evasion and fraudulent activities.

Streamlining financial transactions and compliance with KYC norms.

What is the last date for PAN link and Aadhaar card?

The last date for PAN link and Aadhaar card is June 30th, 2023.

What is the cost of PAN Aadhaar link?

The cost of PAN Aadhaar link is Rs. 1000/-, which is non-refundable.

What will happen if we don’t link Aadhaar with PAN?

If you fail to link your Aadhaar with PAN, the PAN card will become inoperative, resulting in several consequences, including:

Inability to file returns using the inoperative PAN.

Non-processing of pending returns and issuance of refunds.

Incompletion of pending proceedings related to defective returns.

Deduction of tax at a higher rate.

Potential difficulties at banks and financial institutions, as PAN is an essential KYC document for financial transactions.

References:

1. Circular No. 7/2022: https://incometaxindia.gov.in/news/circular-no-7-2022.pdf

2. Circular No. 3/2023: https://incometaxindia.gov.in/communications/circular/circular-03-2023.pdf

3. Notification No. 37/2017: https://incometaxindia.gov.in/communications/notification/notification37_2017.pdf

Explore more details and articles related to Taxation on our dedicated page created for the purpose. Click Here